40 gift card cash out law

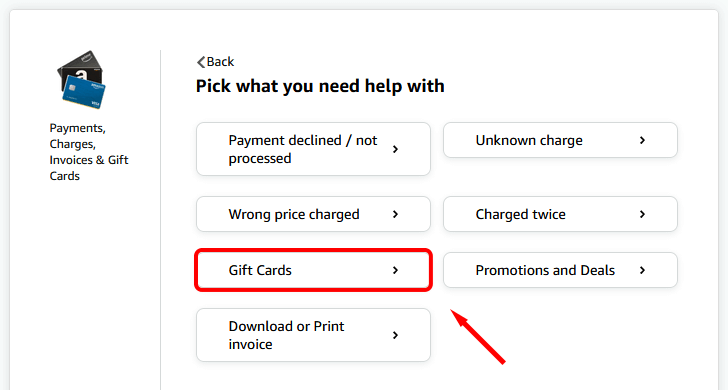

Cash out gift card balance for a retail customer - Commerce | Dynamics ... The purpose of the cash out feature is to allow cashiers to cash out the remaining amount on a gift card. Retailers often need to exchange a low balance gift card for cash at the customer's request. Prerequisites The payment connector and corresponding payment gateway or processor must support the feature. All About the Gift Card Refund Law - DoNotPay The gift card refund law refers to the cash back policy that several U.S. states and territories have regarding the gift cards and certificates sold after January 1, 1997. The law states that if the customer requests a refund, a company or restaurant is required to: Redeem a gift card or certificate for its cash value

Millions in Gift Cards Go Unused. A California Law is On Your Side Though If you have partially used gift cards sitting around your home, you're not alone. It's estimated that millions of dollars in gift cards go unspent. But one California law is designed to...

Gift card cash out law

The $10 Limit: Court Clarifies California's Law on ... - Pillsbury Law The federal District Court, Southern District of California, issued the first decisions interpreting Section 1749.5 (b) of California's Gift Card Law since its amendment in 2007 confirming that merchants have the right to refuse to redeem a gift card for cash where the balance is $10 or more. In 2009, two class actions, Marilao v. Gift-Card Issuers: Mind State Cash-Back Requirements The cash-out provision was added to California's gift-card law in 2008 and has seen enforcement from both public and private litigants since. In August 2009, District Attorneys for Sonoma, Monterey and Shasta counties settled a claim against Starbuck's for failure to honor the cash-out provision. States That Provide Cash Refunds for Gift Card Balances According to the National Conference of State Legislatures (NCSL), 10 states require retailers to provide a cash refund, up to a certain amount, for a gift card ' s remaining value (see Table 1). The maximum amounts that these states require retailers to redeem range from $0.99 in Rhode Island and Vermont to $9.99 in California, with the most ...

Gift card cash out law. Where is it required by law to redeem gift cards for cash - Law info Any gift certificate sold after January 1, 1997, is redeemable in cash for its cash value, or subject to replacement with a new gift certificate at no cost to the purchaser or holder. … California laws governing gift cards and gift certificates cannot be waived. Can you exchange gift cards for cash at Walmart? Expired Gift Card? Know the Law & Maximize Your Gift Cards Gift card Expiration Laws and Gift Card State Laws. Thankfully, gift certificates and store gift cards don't expire for five years because of the Credit CARD Act of 2009. At the same time, if you don't use your card within a year, issuers can charge you an "inactivity fee.". All 50 states are subject to this rule. Gift Certificates and Gift Cards - ct What you should know about Gift Cards in Connecticut: Certain qualifying gift certificates and gift cards cannot have an expiration date or inactivity fee. For most gift certificates and gift cards, a business must provide a cash refund upon consumer request for any gift card balance less than $3.00 after a purchase is made. Stores in These States Must Give You Cash for Your Gift Cards - Lifehacker California: Any gift card worth less than $10 is redeemable in cash. Colorado: You can redeem any card worth less than $5 for cash. Connecticut: The merchant must redeem the card balance...

Chapter 19.240 RCW: GIFT CERTIFICATES - Washington It is the intent of the legislature to relieve businesses from the obligation of reporting gift certificates as unclaimed property. In order to protect consumers, the legislature intends to prohibit acts and practices of retailers that deprive consumers of the full value of gift certificates, such as expiration dates, service fees, and dormancy and inactivity charges, on gift certificates. PDF New IRS Advice on Taxability of Gift Cards Treatment of Employer ... The example in Reg.§1.132-6(a) of holiday gifts is limited to property; it does not include cash (except for special rules that apply to transit passes and/or occasional meal money). The same regulation states that cash is not excludable even when it is provided to purchase a property or service that, if provided in kind, would be excludable as... Gift Card Laws by State 2022 - worldpopulationreview.com In some states, people can only redeem gift cards once they reach a specific amount. This amount is typically small, like $5-$10, but it could be a more significant amount in other states. Many states, on the other hand, do not apply this rule to gift cards. They will require individuals to spend all the money on the gift card until it expires. Terms And Condition | Gift Card to Cash Service or Payment Processing Fee. Users are charged 15% service fee by GiftCardToCash for each gift card cash out transaction. 7. Governing Law. Any claim relating to GiftCardToCash's web site shall be governed by the laws of the State of Washington State without regard to its conflict of law provisions. General Terms and Conditions applicable ...

Gift Cards | Federal Trade Commission These rules apply to two types of cards: Retail gift cards, which can only be redeemed at the retailers and restaurants that sell them; and bank gift cards, which carry the logo of a payment card network like American Express or Visa and can be used wherever the brand is accepted. New Gift Card Laws | Consumer Law Once a gift card has been issued, there is a ban on charging any post-purchase fee, including: activation fees account keeping fees balance enquiry fees. The ban does not cover fees that a business can charge as part of a sale to cover the cost of processing a payment. Post purchase fees do not include: overseas transaction fees booking fees FAQs and Tips on Gift Certificates and Gift Cards: Legal Guide S-11 The gift certificate law states that a seller must either redeem a gift certificate or gift card sold after January 1, 1997, for its cash value, or replace it with a new certificate or card at no cost. 18 However, California's Legislative Counsel has concluded that a seller is not required to redeem a gift certificate in cash when requested by a... PDF Brian E. Frosh, Maryland Attorney General Gift Cards Store-specific gift certificates or cards are those that may be used to buy merchandise only from a particular store and its aliates. Under Maryland law, store-specific gift cards may not expire for at least four years after the date of purchase, and the issuer may not impose fees or charges of any kind during that four-year period. Federal legi...

Gift card questions answered | Washington State I checked the Web site of the store Ned visited and found this clause among the policies, "Gift cards may not be returned, applied as payment on any account or redeemed for cash, except where required by law." So what do you do with those unwanted gift cards? A number of Web sites allow you to turn them into cash.

Chapter 501 Section 95 - 2012 Florida Statutes - The Florida Senate (2) 1 (a) A gift certificate purchased or credit memo issued in this state may not have an expiration date, expiration period, or any type of postsale charge or fee imposed on the gift certificate or credit memo, including, but not limited to, service charges, dormancy fees, account maintenance fees, or cash-out fees.

PDF Gift Cards and Gift Certificates Statutes and Recent Legislation Eco-Gift Card Act, Public Law 111-209 Delays certain disclosure requirements in the Credit CARD Act of 2009 until January 31, 2011, as specified. ... cash out fee, a gift card replacement fee, an activation fee, or a reactivation fee, if the following disclosures are printed clearly in a

Gift cards and discount vouchers | ACCC A gift card, sometimes known as a gift voucher, is usually loaded with an amount of money. The person who receives the gift card can exchange it for goods or services to the value of the amount on the card. A gift card may be in physical or electronic form. It may be provided as a card, voucher or a code sent electronically.

12 CFR § 205.20 - Requirements for gift cards and gift certificates. The terms "gift certificate," "store gift card," and "general-use prepaid card", as defined in paragraph (a) of this section, do not include any card, code, or other device that is: (1) Useable solely for telephone services; (2) Reloadable and not marketed or labeled as a gift card or gift certificate. For purposes of this paragraph ...

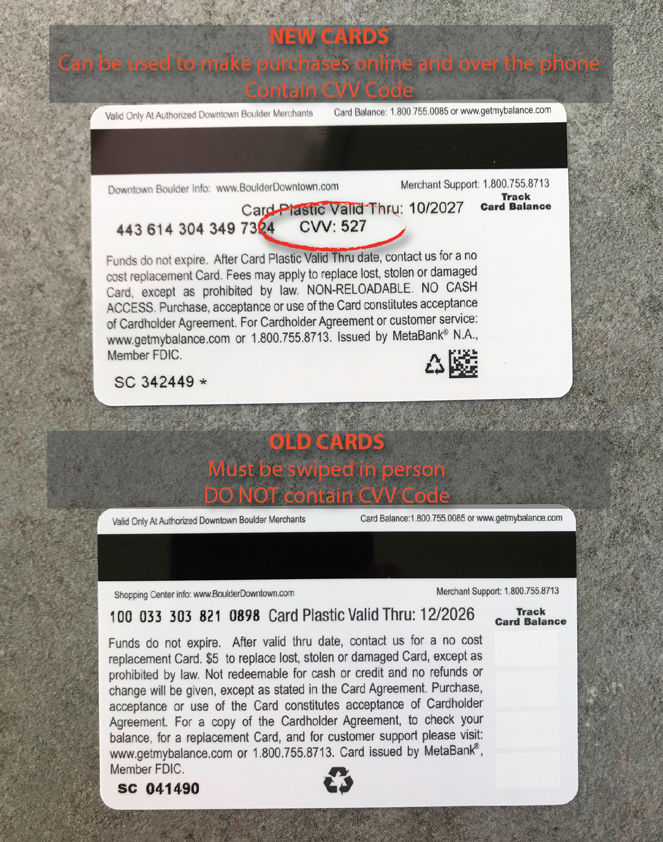

Gift Card Laws: An Interactive State-by-State Guide - Class Action In some states, you can actually redeem gift cards for cash once they reach a certain amount - typically between $5 and $10. If you live in one of these states, simply take the gift card to the retailer and request that you receive cash for the remaining balance.

What Are the Gift Card Laws by State? [Top Info] - DoNotPay This can normally happen once the card reaches a specific amount. These are the states where you can redeem gift cards worth at most: $10—California $5—Colorado, Maine, Massachusetts, Montana, New Jersey, Oregon, Washington $1—Rhode Island If you don't want to bother yourself with the state laws on your own, you can turn to DoNotPay for help.

FDIC Consumer News: What You Should Know About Gift Cards Bank gift cards, which carry the logo of a payment card network (e.g., Visa, MasterCard), are also subject to Credit CARD Act protections and can be used wherever the brand is accepted. Under the law, a gift card cannot expire until at least five years from the date it was activated. The law also places general limitations on fees.

Gift Cards and Gift Certificates Statutes and Legislation The law provides that gift cards cannot expire within five years from the date they were activated and generally limits inactivity fee on gift cards except in certain circumstances, such as if there has been no transaction for at least 12 months.

Gift Cards Expiration Laws - A State By State Review - Class Action Federal law also stipulates that fees must be disclosed either on the card itself or associated packaging, that post-sale fees can't be imposed until the card has been inactive for more than one year, and that only one post-sale fee per month is permitted.

States That Provide Cash Refunds for Gift Card Balances According to the National Conference of State Legislatures (NCSL), 10 states require retailers to provide a cash refund, up to a certain amount, for a gift card ' s remaining value (see Table 1). The maximum amounts that these states require retailers to redeem range from $0.99 in Rhode Island and Vermont to $9.99 in California, with the most ...

Gift-Card Issuers: Mind State Cash-Back Requirements The cash-out provision was added to California's gift-card law in 2008 and has seen enforcement from both public and private litigants since. In August 2009, District Attorneys for Sonoma, Monterey and Shasta counties settled a claim against Starbuck's for failure to honor the cash-out provision.

The $10 Limit: Court Clarifies California's Law on ... - Pillsbury Law The federal District Court, Southern District of California, issued the first decisions interpreting Section 1749.5 (b) of California's Gift Card Law since its amendment in 2007 confirming that merchants have the right to refuse to redeem a gift card for cash where the balance is $10 or more. In 2009, two class actions, Marilao v.

:max_bytes(150000):strip_icc()/Ross-Dress-for-Less-Worst-Gift-Card-Rules-Fees-576ce6355f9b585875053e1a.jpg)

:max_bytes(150000):strip_icc()/Which-Is-Safer-PayPal-or-a-Credit-Card-edit-8c155ccf0e5340188eeb414b1f8d02f4.jpg)

0 Response to "40 gift card cash out law"

Post a Comment