38 gift card to employee taxable

› government-entities › federal-stateDe Minimis Fringe Benefits | Internal Revenue Service Jul 06, 2022 · Gift certificates that are redeemable for general merchandise or have a cash equivalent value are not de minimis benefits and are taxable. A certificate that allows an employee to receive a specific item of personal property that is minimal in value, provided infrequently, and is administratively impractical to account for, may be excludable as ... › publications › p519Publication 519 (2021), U.S. Tax Guide for Aliens | Internal ... Would any U.S. estate or gift taxes apply to me, my estate, or an estate for which I am an executor, trustee, or representative? See U.S. federal estate and gift tax in Reminders. What is the tax rate on my income subject to U.S. tax? See chapter 4. I moved to the United States this year. Can I deduct my moving expenses on my U.S. return?

Are Gift Cards taxable For Employees - Blackhawk On Demand While the expense of the gift card is completely payable by the company, you must pay tax from the worker's compensation for all these incentives. • Employee protection and performance rewards of real property, such as a watch, can be deducted up to $400 per year per worker.

Gift card to employee taxable

Publication 519 (2021), U.S. Tax Guide for Aliens | Internal … The information in this publication is not as comprehensive for resident aliens as it is for nonresident aliens. Resident aliens are generally treated the same as U.S. citizens and can find more information in other IRS publications at IRS.gov/Forms.. Table A provides a list of questions and the chapter or chapters in this publication where you will find the related discussion. Are Gift Cards Taxable to Employees? - Eide Bailly Are Gift Cards Taxable? Gift cards given to employees count as taxable income and must be reported on Form W-2. However, people often incorrectly assume that IRS rules on gift cards to employees are also covered under de minimis fringe benefit rules. What Are De Minimis Fringe Benefits? Is a Gift to a Former Employee Taxable? - Mitchell Tax Law Generally, for the recipient, gifts are not subject to income tax; whereas, compensation is subject to income tax. The exclusion for gifts is found in Section 102: Gross income does not include the value of property acquired by gift, bequest, devise, or inheritance. This section also says that it does not exclude any amount transferred by or ...

Gift card to employee taxable. Ask the Expert: Are All Gift Cards Taxable Income? - HR Daily Advisor So the short answer would be that any gift card that serves as a cash equivalent - for example, a $25 Amazon.com gift card or a Visa cash card - would always be taxable regardless of the amount because there is no difficulty in accounting for the monetary value of the gift. Are Small Gifts To Employees Taxable? - LegalProX Are gifts to employees deductible? According to the IRS, your gifts to employees are deductible as business expenses and can be as high as $25 per recipient per year. It is possible to deduct gifts like a holiday ham. What gifts are taxable? If you give up to $15,000 to someone in a year, you don't have to worry about the IRS. Can I give my employee a gift card without being taxed? Because gift cards are essentially the same as cash, they are considered an easy item to be accounted for and, therefore, taxable. There used to be a threshold of $25 to be the maximum amount that could be gifted before having to be taxed, but that is no longer the case. A gift card or cash equivalent is now taxable, regardless of the amount. › instructions › i709Instructions for Form 709 (2022) | Internal Revenue Service In 2011, A expended $2,400,000 of the applicable exclusion on the taxable gift to B. The second step of the procedure is to repeat the first step for every year where the donor made a taxable gift to a same-sex spouse. The third step of the procedure is to add up the result for all the years.

Are Gift Cards Taxable? | Taxation, Examples, & More - Patriot … 02.08.2022 · Let’s say you wanted to give an employee a $100 gift card for the holidays. You decide to use the percentage method for federal income tax. Follow these steps to determine how much to withhold from the gift card for taxes: First, multiply the gift card value by 22% to find the federal income tax: $100 X 0.22 = $22.00 FAQ: Are Gift Cards for Employees a Tax Deduction? - Level 6 Incentives After all, if you can't deduct the cost of those incentives to your employees, then it won't matter whether it's a gift card or another form. The answer is yes, with qualifications. You are allowed to deduct all, or part, of the costs of a gift, up to a specific limit per employee. That limit is $25 per employee per tax year. Publication 15-B (2022), Employer's Tax Guide to Fringe Benefits You establish a written policy under which you don't allow the employee, nor any individual whose use would be taxable to the employee, to use the vehicle for personal purposes other than for commuting or de minimis personal use (such as a stop for a personal errand on the way between a business delivery and the employee's home). Personal use of a vehicle is all use … › individuals › international-taxpayersFrequently Asked Questions on Virtual Currency Transactions For purposes of determining whether you have a gain, your basis is equal to the donor’s basis, plus any gift tax the donor paid on the gift. For purposes of determining whether you have a loss, your basis is equal to the lesser of the donor’s basis or the fair market value of the virtual currency at the time you received the gift.

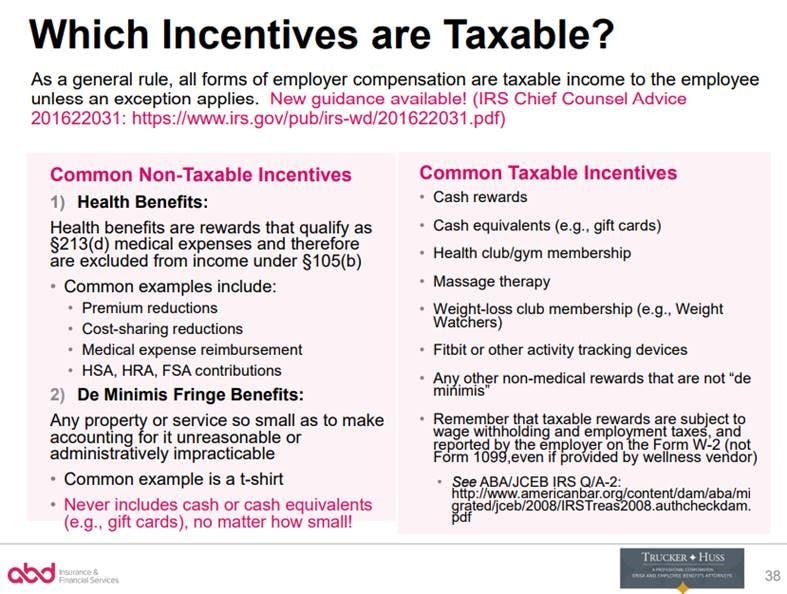

Are Gifts for Your Team and Clients Tax Deductible in the U.S.? The cost of the gift card is fully deductible to the business, but you must withhold taxes from the employee's pay for these gifts. Team Gift Type 3: Awards You can deduct up to $400 of the cost of employee safety and service awards of tangible personal property (such as a watch) for each employee for each year. Gifts for employees and clients: Tax FAQs answered - MYOB Pulse Yes, an employer can give a gift to an employee. But there are tax implications depending on whether the gift is: an entertainment or non-entertainment gift, and costs more or less than $300. See below for more about entertainment and non-entertainment gifts. Holding a party can also be a great idea (where restrictions allow). Are Gift Cards Taxable? | Taxation, Examples, & More - Patriot Software First, multiply the gift card value by 22% to find the federal income tax: $100 X 0.22 = $22.00 Now, multiply the gift card value by 6.2% to find the Social Security tax (unless the employee has reached the Social Security wage base ): $100 X 0.062 = $6.20 Are Gifts to Employees Taxable? - SST Accountants & Consultants Cash and cash equivalents, such as gift cards or bonuses, are never "de minimis," no matter the amount, and must be added to an employee's taxable wages. For example, should an employer decide to gift an employee with a turkey for Thanksgiving, the gift would be "de minimis" and, therefore, not taxable because the gift is infrequent ...

Are Employee Gift Cards Considered Taxable Benefits? - Strategic HR According to the IRS, cash, gift certificates, and gift cards are considered taxable fringe benefits and must be reported as wages. But you may be relieved to know that this rule doesn't apply to all gifts or perks that you may give to employees. The IRS tells us that we can exclude the value of a "de minimis" benefit from an employee's wages.

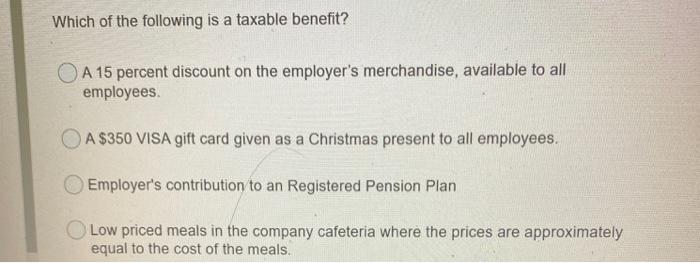

Gifts to Employees - Taxable Income or Nontaxable Gift? All cash or gift cards redeemable for cash are taxable to the employee, even when given as a holiday gift. Monetary prizes, including achievement awards, as well as non-monetary bonuses like vacation trips awarded for meeting sales goals, are taxable compensation - not just for income taxes, but also for FICA. Withholding applies.

Are Employee Gifts Taxable? Everything You Need To Know 21.10.2020 · Gift certificates, gift cards and cash equivalent benefits are never tax-exempt. This is something the IRS is very clear about. Even if they are given out as holiday or birthday presents from an employer to an employee, these types of gifts are never considered de minimis fringe benefits, and are thus liable to taxation. This is likely due to ...

Must-Know Tax Rules for Employee Gift Cards: 2022 Update - Giftogram To save on the tax dollars associated with employee gifts, you can opt to build gift card taxes into employee's salary using this simple formula: Face Value of the Gift Card x Tax Percentage/1-Tax Percentage. 3 Big Benefits of Giftogram Gift Cards for Employees and Customers Manage Gift Card Transactions with Giftogram's Reporting Tools

Are Employee Gift Cards Considered Taxable Benefits? 12.10.2022 · Employee awards are an important part of employee engagement. It is important, however, to make sure you don’t turn that $100 thank you gift card into a much more expensive “gift” by assuring you are properly handling the taxes accompanying such a gift.

Publication 970 (2021), Tax Benefits for Education | Internal … 463 Travel, Gift, and Car Expenses. 525 Taxable and Nontaxable Income. 550 Investment Income and Expenses. 590-A Contributions to Individual Retirement Arrangements (IRAs) 590-B Distributions from Individual Retirement Arrangements (IRAs) Form (and Instructions) 1040 U.S. Individual Income Tax Return. 1040-NR U.S. Nonresident Alien Income Tax Return. 1040-SR …

› publications › p15bPublication 15-B (2022), Employer's Tax Guide to Fringe ... Moving expense reimbursements. P.L. 115-97, Tax Cuts and Jobs Act, suspends the exclusion for qualified moving expense reimbursements from your employee's income for tax years beginning after 2017 and before 2026. However, the exclusion is still available in the case of a member of the U.S. Armed Forces on active duty who moves because of a permane

Are gift cards taxable employee benefits? | PeopleKeep Yes, gift cards are taxable when offered to employees. The IRS considers it as cash-equivalent, meaning you must report the card's value on an employee's Form W-2 just like a wage. This is the same as taxable fringe benefits such as employee stipends, which must also be reported as wages on employees' W-2s.

Know the tax rules for gifts to employees and customers - Beliveau Law But if you give an employee cash (or a cash equivalent), that's always considered wages, even if the amount is de minimis. So if you give an employee a $10 Starbucks gift card as a thank-you for working late, the $10 is considered taxable. Stock options are also taxable, and can be subject to complex rules.

› publications › p970Publication 970 (2021), Tax Benefits for Education | Internal ... But this allows payments made in cash, by check, by credit or debit card, or with borrowed funds such as a student loan to be applied to qualified education expenses. Example 1—No scholarship. Bill Pass, age 28 and unmarried, enrolled full-time in 2021 as a first-year student at a local college to earn a degree in law enforcement.

Stock Quotes, Business News and Data from Stock Markets | MSN … 23.11.2022 · Get the latest headlines on Wall Street and international economies, money news, personal finance, the stock market indexes including Dow Jones, NASDAQ, and more. Be informed and get ahead with ...

PDF New IRS Advice on Taxability of Gift Cards Treatment of ... - IRS tax forms and any unused portion is forfeited). However, Federal tax law does not view giving an employee a turkey or a ham as the equivalent of giving an employee a gift card to purchase a turkey or a ham. A recently issued Tax Advice Memorandum (TAM) in 2004 clarifies the tax law and discusses this issue.

› publications › p463Publication 463 (2021), Travel, Gift, and Car Expenses ... They paid $80 for each gift basket, or $240 total. Three of Local Company's executives took the gift baskets home for their families' use. Bob and Jan have no independent business relationship with any of the executives' other family members. They can deduct a total of $75 ($25 limit × 3) for the gift baskets.

Gift Tax | Internal Revenue Service - IRS tax forms 04.02.2022 · The gift tax is a tax on the transfer of property by one individual to another while receiving nothing, or less than full value, in return. The tax applies whether or not the donor intends the transfer to be a gift. The gift tax applies to the transfer by gift of any type of property. You make a gift if you give property (including money), or ...

Can An Employer Give A Gift Card To An Employee? However, gift cards may become a logistical headache for employers, and employees may be irritated by a tax surprise. If you insist on giving gift cards, make sure your workers are aware of the tax implications. ... They allow employers to express gratitude with a gift card which saves employees time by choosing from a variety of stores or ...

Taxability of Gift Certificates | Payroll Services | Washington State ... Gift certificates or gift cards to the Bookie, Home Depot, Nordstrom, etc., which are given to employees for any reason and for any amount are taxable to the employee. Payroll Services will tax employees using the earnings type "Fair Market Value" (FMV) or FMS for students. Accounts Payable will provide payment information to Payroll Services.

Expenses and benefits: gifts to employees - GOV.UK Expenses and benefits: gifts to employees As an employer providing gifts to your employees, you have certain tax, National Insurance and reporting obligations. Businesses There are different...

How To Tax Gift Cards In Payroll? - Law info How much tax do you pay on a gift card to an employee? To give your employees a gift card with a value of $100 after taxes, record it as $142.15 gross and withhold $42.15 for taxes. When you give gift cards to employees, include the value in the employee's wages on Form W-2. Are gift cards subject to payroll taxes?

Are gift cards taxable? | Kroger Gift Cards Yes, gift cards are taxable when received when given to an employee from an employer. Employees will have to claim any funds received on gift cards from their employer in their tax return. Employers will also have to pay tax on any gift cards they give to employees. The IRS will expect tax to be paid on gift cards, even in values as low as $5.

Frequently Asked Questions on Virtual Currency Transactions A32. Your basis in virtual currency received as a bona fide gift differs depending on whether you will have a gain or a loss when you sell or dispose of it. For purposes of determining whether you have a gain, your basis is equal to the donor’s basis, plus any gift tax the donor paid on the gift. For purposes of determining whether you have a ...

Are Employee Gifts Taxable? Everything You Need To Know Cannot be disguised wages or supplemental wages (gifts that are meant to replace taxable compensation) Should not exceed a value of $100 (individual items) Gift certificates, gift cards and cash equivalent benefits are never tax-exempt This is something the IRS is very clear about.

Are Gift Cards Taxable? IRS Rules Explained Grossing up means you increase the value of the gift card to account for the taxes that will be taken from it. So, if the gift card is subject to about 30 percent in taxes, you would give your...

Gifts, awards, and long-service awards - Canada.ca Where our policy on non-cash gifts and awards applies, only amounts over the $500 limit must be included in the employee's income. For example, if you provide gifts and awards with a total value of $650, there is a taxable benefit of $150 ($650 - $500). Include items whose FMV may have been altered by a logo or engraving in the calculation.

Tax Rules of Employee Gifts and Company Parties - FindLaw Taxable gifts: Gift certificates (cash in kind) are wages subject to taxes -- even for a de minimis item. For example, a gift certificate for a turkey is taxable, even though the gift of a turkey is not. Cash gifts of any amount are wages subject to all taxes and withholding. Gifts Under $25: Gifts under $25 are typically tax-exempt.

De Minimis Fringe Benefits | Internal Revenue Service - IRS tax … 06.07.2022 · Gift certificates that are redeemable for general merchandise or have a cash equivalent value are not de minimis benefits and are taxable. A certificate that allows an employee to receive a specific item of personal property that is minimal in value, provided infrequently, and is administratively impractical to account for, may be excludable as a de …

Reminder: Holiday Gifts, Prizes or Parties Can Be Taxable Wages - SHRM Here are the tax rules employers should know if they are planning on thanking their employees with gifts, prizes or a party this holiday season. Reminder: Holiday Gifts, Prizes or Parties Can...

Is a Gift to a Former Employee Taxable? - Mitchell Tax Law Generally, for the recipient, gifts are not subject to income tax; whereas, compensation is subject to income tax. The exclusion for gifts is found in Section 102: Gross income does not include the value of property acquired by gift, bequest, devise, or inheritance. This section also says that it does not exclude any amount transferred by or ...

Are Gift Cards Taxable to Employees? - Eide Bailly Are Gift Cards Taxable? Gift cards given to employees count as taxable income and must be reported on Form W-2. However, people often incorrectly assume that IRS rules on gift cards to employees are also covered under de minimis fringe benefit rules. What Are De Minimis Fringe Benefits?

Publication 519 (2021), U.S. Tax Guide for Aliens | Internal … The information in this publication is not as comprehensive for resident aliens as it is for nonresident aliens. Resident aliens are generally treated the same as U.S. citizens and can find more information in other IRS publications at IRS.gov/Forms.. Table A provides a list of questions and the chapter or chapters in this publication where you will find the related discussion.

0 Response to "38 gift card to employee taxable"

Post a Comment